Introduction to Futures Trading: A Beginner’s Guide

For beginners, understanding the basics of futures trading is key before you jump in. Even if you have experience in forex, this guide will help you broaden your trading horizons.

We will walk you through what futures contracts are, how futures trading works, the role of leverage, the most common markets to trade, practical steps to get started, and the essential terms you need to know. While the subject can get technical, this article keeps the tone casual and realistic, helping you build a solid foundation without the hype.

What Are Futures Contracts?

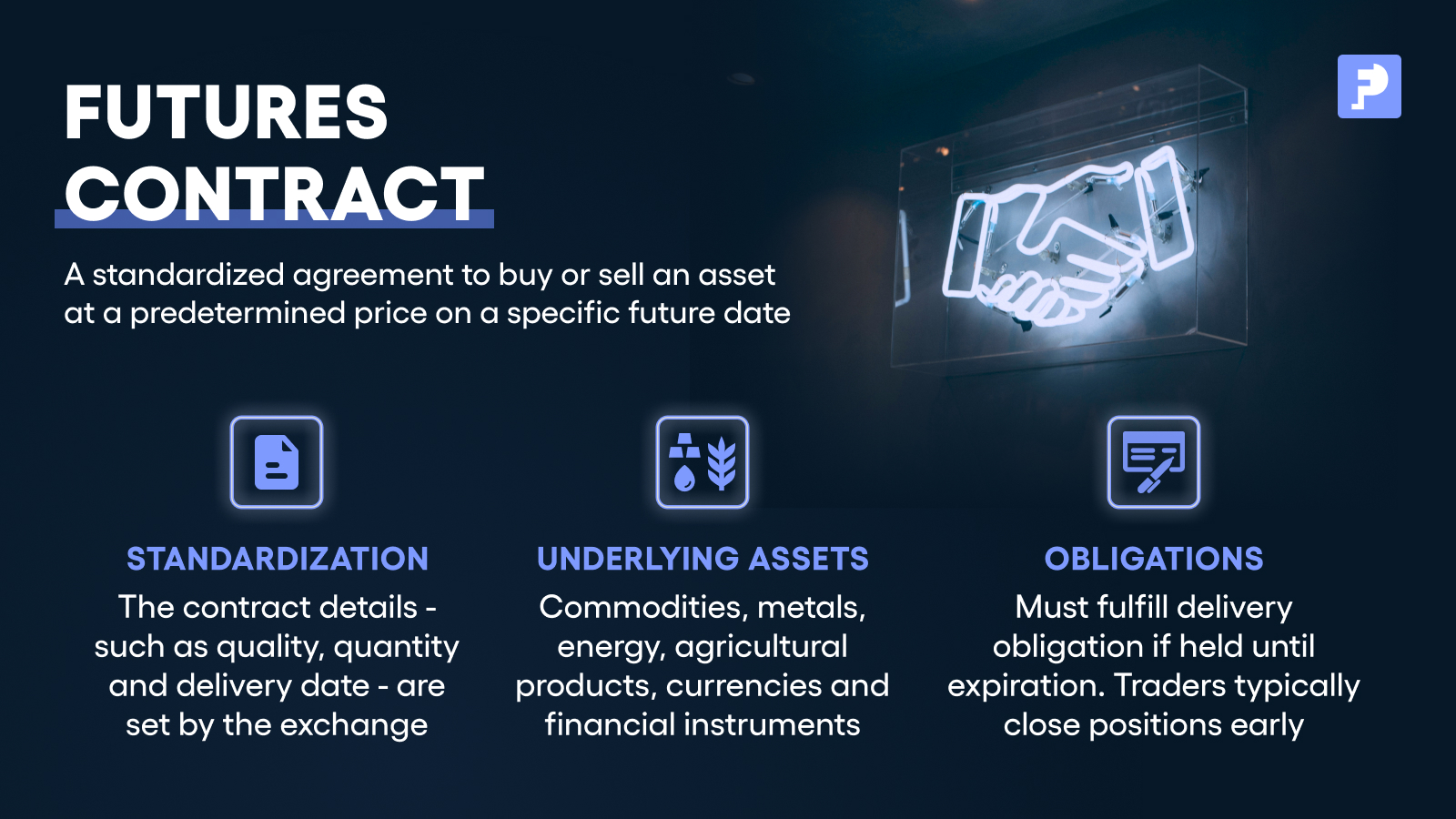

A futures contract is a standardized agreement to buy or sell an asset at a predetermined price on a specific future date. In simpler terms, it’s a promise between two parties: one commits to buying, and the other to selling the asset when the contract expires.

Key points about futures contracts:

- Standardization: The contract details—such as quality, quantity, and delivery date—are set by the exchange. This makes all contracts of the same type identical, eliminating the need to negotiate every detail.

- Underlying Assets: Initially used for commodities (like grains and livestock), futures now cover a wide range, including metals (gold, silver), energy (oil, natural gas), agricultural products (corn, wheat), currencies, and even financial instruments like stock indexes.

- Obligations: If you hold the contract until expiration, you must fulfill the delivery obligation (either by actual delivery or cash settlement). However, most traders close (offset) their positions before expiration to avoid this.

In essence, futures are used in two primary ways:

- Hedging: Businesses and producers use futures to lock in prices and manage risk. For instance, a farmer may sell wheat futures to secure a future selling price.

- Speculation: Traders who wish to profit from price movements use futures to take positions on the future direction of asset prices (this is what interests us, and how traders make money).

How Does Futures Trading Work?

Futures trading takes place on regulated exchanges such as those operated by CME Group. Here’s a concise overview of the trading process:

- Order Execution:

- You place an order through a futures broker.

- The broker sends your order to the exchange.

- The exchange’s clearinghouse guarantees every trade, reducing the risk of default.

- Positions – Long and Short:

- Long Position: Buying a futures contract with the expectation that the price will rise.

- Short Position: Selling a futures contract with the expectation that the price will fall.

Trading is symmetrical; going short is as straightforward as going long.

- Margin and Daily Settlement:

- Initial Margin: Rather than paying the full contract value, you deposit a fraction (usually 3% to 12%) as collateral.

- Mark-to-Market: At the end of each trading day, the exchange adjusts your account based on that day’s price movements. Gains or losses are settled daily.

- Maintenance Margin: A lower threshold you must maintain. If your account falls below this level, you receive a margin call to add funds.

- Closing Positions:

- Speculators close their positions before the contract expires. For example, if you bought a contract, you can sell an identical one later to “offset” your position, thus avoiding delivery.

Leverage in Futures Trading

One of the main attractions (and risks) in futures trading is leverage. Leverage allows you to control a large position with a relatively small amount of capital.

Consider these key points:

- Amplified Gains and Losses: Since you only need to post a small margin, even small price moves can result in large percentage gains—or losses—relative to your initial investment. Example: Imagine a futures contract with a notional value of $50,000 and an initial margin of $5,000 (10%). A 10% move in the underlying price equals a $5,000 gain or loss, effectively doubling your money or wiping it out.

- Risk Management: Because losses can exceed your initial deposit, it’s crucial to use tools like stop-loss orders and to trade with conservative position sizes. Never risk money you can’t afford to lose. This is true on both cash and prop trading accounts: just like you don’t want to lose money, you don’t want to blow your challenge either.

Leverage is a double-edged sword—it can multiply profits, but it can also multiply losses, making careful risk management essential.

Common Markets for Futures Trading

Futures contracts cover a wide range of markets. Here’s a brief look at the major categories:

- Stock Index Futures: Trade futures based on stock market indexes (e.g., E-mini S&P 500, Nasdaq-100). These are popular for speculating on overall market direction and are typically cash-settled.

- Agricultural Futures: These include contracts on commodities like corn, wheat, soybeans, and livestock. Originally used by farmers and food processors, they are now also popular among speculators.

- Energy Futures: Futures on crude oil, natural gas, heating oil, and gasoline. Crude oil futures, for instance, are closely watched globally for price trends.

- Metal Futures: Trade precious metals (gold, silver) and industrial metals (copper). These contracts allow traders to gain exposure to the price movements of these commodities without owning physical metal.

- Currency Futures: Also known as FX futures, these contracts let you trade exchange rates (e.g., Euro, British Pound, Japanese Yen). They are used by both businesses for hedging and by speculators.

- Interest Rate Futures: Include contracts on government bonds and notes, such as U.S. Treasury futures. They are used to hedge or speculate on interest rate changes.

To illustrate, here’s a useful table of a few popular futures contracts:

| Contract | Underlying | Minimum Tick | Tick Value |

| E-mini S&P 500 (ES) | $50 × S&P 500 Index value | 0.25 index points | $12.50 per tick |

| WTI Crude Oil (CL) | 1,000 barrels of crude oil | $0.01 per barrel | $10.00 per tick |

| Gold (COMEX GC) | 100 troy ounces of gold | $0.10 per troy ounce | $10.00 per tick |

| Corn (CBOT ZC) | 5,000 bushels of corn | 0.25¢ per bushel | $12.50 per tick |

This table shows that each contract has a set size and a minimum price increment (tick). For example, an E-mini S&P 500 futures contract, with its $50 multiplier and a 0.25-point tick, means each tick movement equals $12.50 in value.

Getting Started in Futures Trading

If you’re ready to try futures trading, here are some practical steps to help you get started:

- Educate Yourself: Read reliable sources (e.g., CME Group, CFTC, our blog) to understand contract specifications, margin requirements, and the risks involved. Consider using trading simulators to practice without risking real money.

- Assess Your Finances: Only use funds that you can afford to lose. Determine your risk tolerance. Given the leverage in futures, even small price moves can have significant impacts on your account.

- Choose a Reputable Broker or Prop Firm: Ensure your futures broker is well-regulated (registered with the CFTC and NFA in the U.S.). Compare trading platforms, commissions, margin requirements, and educational resources. Read reviews and check regulatory records to avoid untrustworthy providers.

- Start Small: Begin with a single contract or even a micro-futures contract if available. This approach helps you gain experience without taking on excessive risk. Use stop-loss orders to manage potential losses and practice good risk management.

- Develop a Trading Plan: Outline your strategy: What markets will you trade? What indicators or analysis will guide your decisions? When will you enter or exit a trade? Set clear risk parameters, such as the maximum percentage of your account to risk on a single trade. Stick to your plan to avoid impulsive decisions, especially in volatile markets. Check out our full guide to the most common mistakes when trading futures.

- Monitor and Reflect: Keep a trading journal to note what works and what doesn’t. Regularly review your trades to improve your strategy. Stay updated on market news and trends that may impact your futures contracts.

Important Terms to Know

Here’s a brief glossary of essential futures trading terms:

- Futures Contract: A standardized agreement to buy or sell an asset at a predetermined price on a specific date.

- Long/Short Position:

- Long: Buying a contract to profit if prices rise.

- Short: Selling a contract to profit if prices fall.

- Hedger vs. Speculator:

- Hedger: Uses futures to protect against price risk (e.g., farmers, airlines).

- Speculator: Trades futures purely to profit from price changes.

- Contract Size (Notional Value): The total value of the asset represented by the contract. For example, a gold contract might cover 100 troy ounces.

- Tick Size: The smallest price increment that the contract can move. Multiply the tick size by the contract size to get the tick value (e.g., crude oil’s tick of $0.01 on 1,000 barrels equals $10 per tick).

- Leverage: The ability to control a large position with a small margin deposit. While it can amplify gains, it also increases potential losses.

- Margin (Initial and Maintenance):

- Initial Margin: The amount required to open a position.

- Maintenance Margin: The minimum balance you must maintain to keep your position open.

- Mark-to-Market: The daily process of settling gains and losses based on that day’s price movements.

- Expiration Date: The set date when the contract is settled, either via physical delivery or cash settlement.

- Settlement (Physical vs. Cash):

- Physical Delivery: Actual exchange of the underlying asset.

- Cash Settlement: The difference between the contract price and the market price is paid in cash.

Conclusion

Futures trading offers a unique way to gain exposure to various markets—from stock indexes and commodities to currencies and interest rates—without having to own the underlying asset. While the opportunity for high returns exists because of leverage, this same feature makes futures trading a high-risk endeavor that requires a solid understanding of how contracts work, disciplined risk management, and a realistic approach.

By knowing what a futures contract is, understanding the trading mechanics (including margin and daily settlement), recognizing the potential and dangers of leverage, and being aware of the specific markets available, you’re better prepared to start your journey in futures trading. Remember to educate yourself continuously, start small, and develop a well-defined trading plan. With practice, patience, and sound risk management, futures trading can become a valuable part of your overall trading strategy.

Sources:

- U.S. Commodity Futures Trading Commission (CFTC) – cftc.gov

- CME Group Educational Materials – cmegroup.com/education

- Investopedia – investopedia.com

All trading in FunderPro Futures takes place in a demo-style environment and in off-exchange futures.